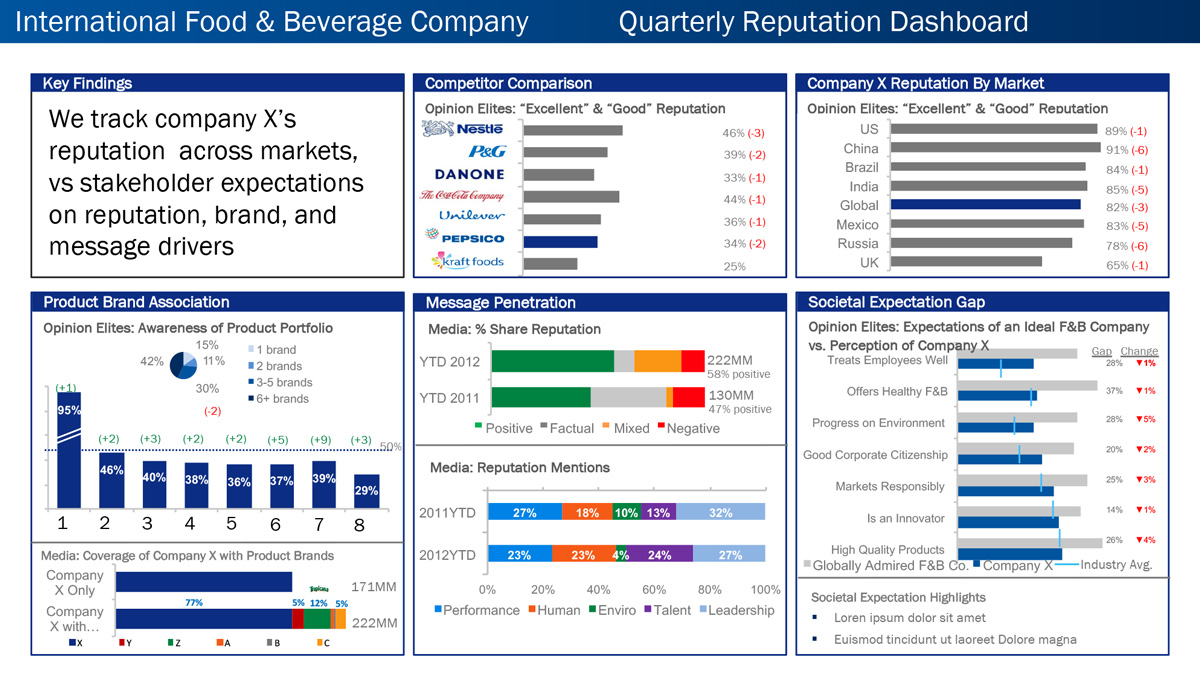

CEOs bear the primary responsibility for managing a company’s reputational risk and performance, yet many executives admit to not knowing how to measure reputation in the first place.

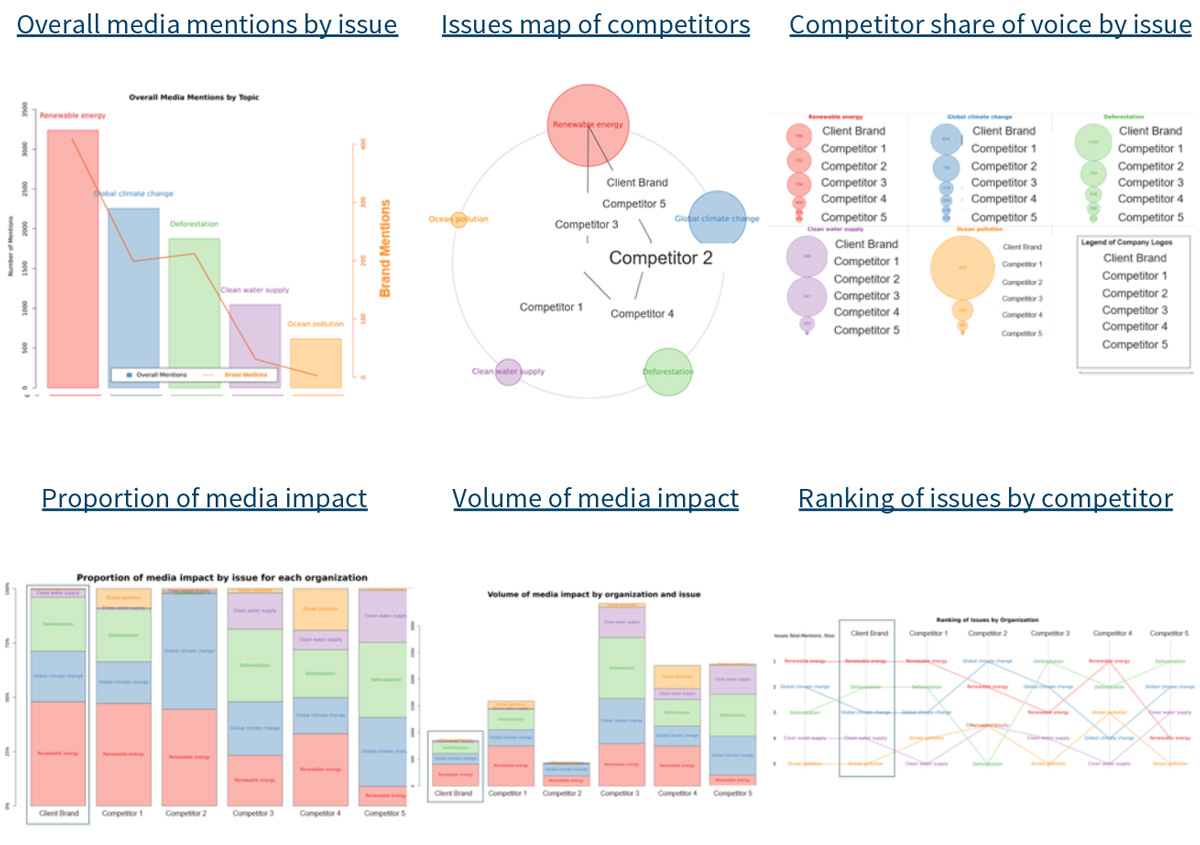

Reputation Leaders takes a rigorous approach to tracking and building a reputation, bringing hard numbers to a ‘soft science’. We quantify the perceptions and gaps around reputation to deliver recommendations that link reputation to business outcomes; such as the employer of choice, customer advocacy, positive media, investor support and regulatory licence to operate.